One-in-four Canadians struggling financially: Angus Reid

Posted Jun 24, 2022 12:28 pm.

Last Updated Jun 25, 2022 8:26 am.

With inflation rates the highest they’ve been since 1983 at 7.7 per cent, Canadians are being forced to be frugal.

A new survey from the Angus Reid Institute suggests a quarter of people in this country are struggling with their finances.

The survey shows cost of living is far and away the most concerning provincial issue to Canadians, with 63 per cent of people ranking it their top worry.

More people say it’s difficult to afford their grocery bill than those who say they have no trouble putting food on the table, compared to data from October of last year. Just over half say it’s hard to feed their household, while 46 per cent say it’s no problem.

Those who earn less are feeling the pinch on their grocery bills the most, 69 per cent of those in the lowest income bracket say they are having trouble with food costs, and at least one third of all Canadians are struggling with feeding their family.

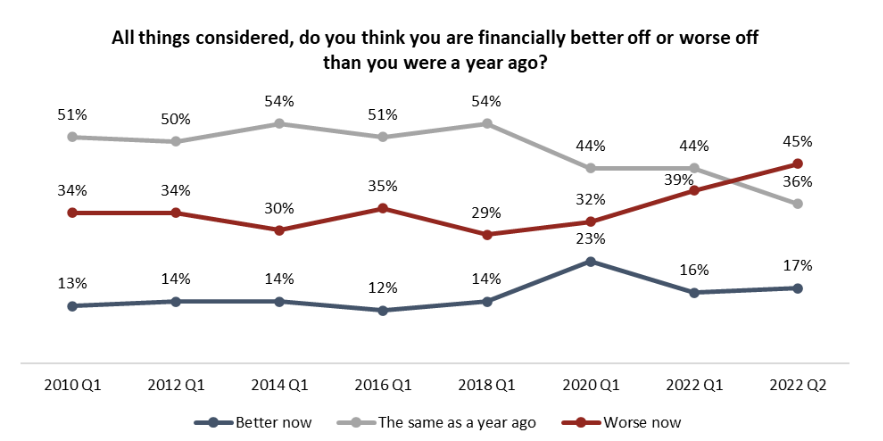

The data suggests just under half of Canadians say they are financially worse off compared to this time in 2021 — the highest amount of people that said this in 12 years. Looking to the future, a majority of people in every province surveyed think things will either stay the same or get worse next year.

(Angus Reid Institute)

Record high gas prices have been plaguing pumps across the country, about a third of Canadians say they are spending more on gas, while almost half say they are spending less on fuel because they’ve switched to another way of getting around. More people say they’ve stayed home when normally they would have gone out, 36 per cent say they have gone further to find cheaper gas, and 11 per cent say they chose to carpool.

Two-in-five Canadians say they have credit card debt, while one-in-five say debt is a major source of stress in their life. People who make less than $50,000 per year are most likely to have debt and for it to be a considerable stressor in their life.

READ MORE:

-

Looking at how Canadians, including non-drivers, are paying more due to soaring gas prices

-

Majority of Canadians believe central bank rate hikes will fuel a recession: poll

-

Canada not ruling out gas tax break amid record inflation, cost of living concerns: Freeland

About 66 per cent of homeowners say they couldn’t afford to make mortgage payments if it costs them an extra $300 a month, with interest rates continuing to rise. Renters are struggling to make ends meet as well, 52 per cent say affording their rent is very difficult, while a third of homeowners feel the same way.

Mortgage rates on homes in Vancouver and Toronto have been hardest hit by increasing interest rates, with average mortgage payments increasing by $526 and $483 respectively. The average cost for a mortgage payment In Canada has gone up by $315.

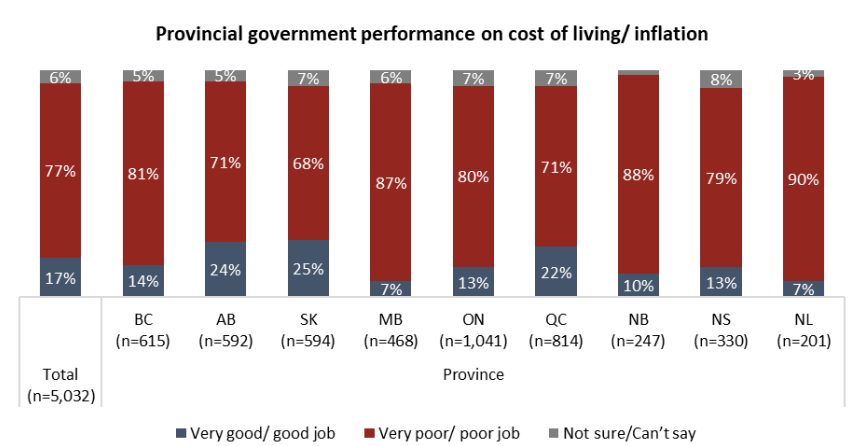

At least 66 per cent of people in every province say they don’t think their government is doing a good job on handling inflation, despite some provinces like Alberta and Quebec taking steps to combat the high cost of living.

(Angus Reid Institute)

Angus Reid’s study also found 41 per cent of Canadians don’t trust the Bank of Canada (BoC) to ease inflation, while only slightly more say they put their faith in the bank.

Conservative leadership candidate Pierre Poilievre recently criticized the BoC, saying he would fire the head of the bank if he’s elected to be prime minister.

People who’ve voted for the Conservative Party and People’s Party in the past are far more likely to have misgivings about the BoC, with 86 per cent saying they don’t trust the bank to do its job. Conversely, 69 per cent of past Liberal voters say they trust the bank.