Alberta has highest auto insurance rates in Canada: report

Posted Dec 12, 2022 8:02 pm.

Last Updated Dec 13, 2022 12:14 pm.

Alberta has some of the highest auto insurance rates in the country, according to a report released by Ernst and Young (EY).

The report was commissioned by the Insurance Corporation of B.C. (ICBC).

There were 30 driver profiles with various ages between 18 and 60, along with different cars. It was determined that Alberta had the majority of the highest rates.

In the report, an 18-year-old student would pay the exact same $1,128 for a 2012 Honda Civic LX in Saskatoon, while the same male driver would pay $6,140, and a woman would pay $4,928.

A woman in her 30s would pay $5,042 for an insurance premium in Calgary driving a 2019 Ford F350 SD XLT, while the same woman would pay $1,412 in Saskatoon.

Of the 30 profiles, Alberta has the highest for 24 of them, 11 for Edmonton, 10 for Calgary, and the remainder for Red Deer.

In comparison, the report says B.C. has some of the cheapest rates in the country.

Read More: Alberta auto-insurance companies took in millions during pandemic: report

NDP Finance Critic Shannon Phillips says the prices result from the UCP lifting caps on auto insurance, which have gone up by 30 per cent.

“Albertans are getting gouged as they struggle to keep their car on the road and food on their table in the middle of an affordability crisis. They’re paying thousands of dollars more per year than other provinces for the same level of insurance. This is highway robbery, but rather than addressing it, the UCP is allowing big insurance companies to charge as much as they want,” Phillips said in a statement.

Phillips makes mention of the Superintendent of Insurance Annual Report, where the province picked up a hefty $2.45 billion in premiums that they paid out in claims in 2021.

An estimate from Statistics Canada says this equals $777 per vehicle, which is around 3.15 vehicle registrations in the province.

“These increases need to stop. We need a government that will help Alberta drivers, not their friends in the insurance industry. An NDP government will implement a freeze on insurance rates and provide real relief for Albertans,” said Phillips.

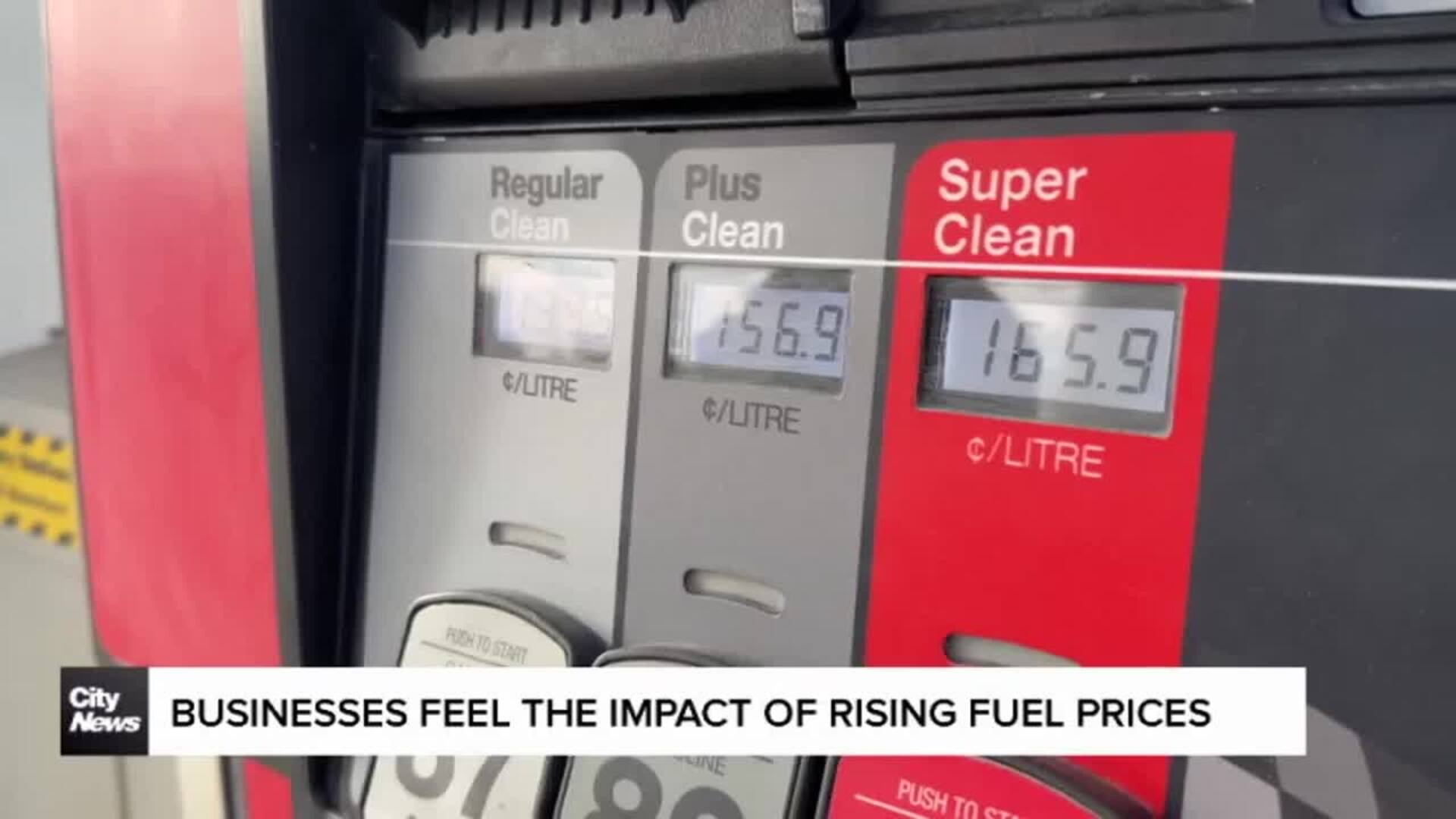

Related Video:

In a statement to CityNews, Alberta Minister of Finance Travis Toews office did not directly speak to the poll but says the NDP cap in 2018 “hurt Albertans, Alberta businesses and insurers,” adding premiums went up by 5 per cent due to the 5 per cent cap in 2018.

“In addition to increased premiums, the NDP rate cap caused many drivers to pay a full year’s premium up-front, rather than monthly, and many were denied collision and comprehensive coverage,” the statement reads.

“Albertans get better auto insurance coverage thanks to changes our government made. As a result of our actions with Bill 41, Alberta drivers saw improvements such as stabilized rates, increased insurance options and flexibility. Albertans injured in traffic accidents can now access more health professionals, like dentists and psychologists, through their insurance claim. Amounts for grief counselling, income replacement and funeral benefits are now adjusted for inflation.

“As well, the 12 month change in insurance premiums as of the end of November this year is 2.4 per cent. This is less than half of what it would have been under the NDP rate cap.”