About 80% in Edmonton, Calgary struggling to pay bills: CityNews poll

Posted Sep 23, 2024 12:15 pm.

Last Updated Sep 23, 2024 12:31 pm.

Price tags, paying for things, affordability. However you want to say it, eye-popping bills are the biggest issue for people in Canada’s big cities, including Edmonton and Calgary.

“I work Monday to Sunday and I barely pay my rent and I’m in debt,” Denver Venoit told CityNews Calgary.

“Our income is fixed. So when the price goes up, we’re just getting a little poorer,” said Misel Desgagné, a senior who added “living lean” is the best way to cope.

According to a new Maru Public Opinion poll for CityNews, 77 per cent of Edmontonians and 80 per cent of Calgarians are finding it tougher and tougher to make ends meet.

RELATED: CityNews poll shows Canadians across 4 major cities share affordability as top concern

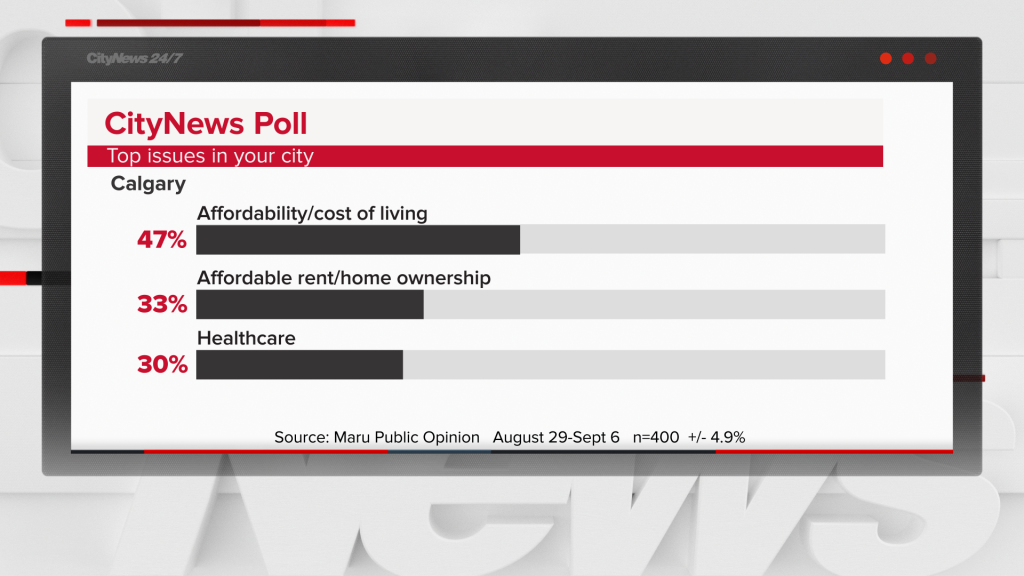

Groceries, housing and utilities are the most worrying price tags, according to the survey that polled 400 people in each city in late August and early September.

The poll looked at Toronto, Vancouver, Calgary and Edmonton, with the Alberta capital scoring the highest on affordability, but still at just 46 per cent. In Calgary, only 30 per cent said the Stampede City is affordable.

“You’re going to find, across this country on any given month, an average of four-in-10 people who can’t make ends meet,” explained John Wright with Maru Public Opinion.

“But the rubber really meets the road in the cities, in the urban areas. We have three-quarters of people in each of the cities, on average, saying ‘we can make ends meet.’”

Business owners passing on high costs

Groceries are the top thing people in Edmonton and Calgary are struggling to afford, with 70 per cent in both cities saying it’s hard just to put food on the table.

At the Bountiful Farmers’ Market in south Edmonton on Friday, some were surprised to hear even 30 per cent are OK with grocery prices.

“I’ve got friends that are now, on a regular basis, trying out two or three different stores every week to try to get the best deal. Obviously if they’re trying that hard, it’s a concern,” said Lesli Olsen, who was selling vegetables.

“It is tough. The only thing I could say to a young couple is, ‘grow a garden. We have a garden every year and it sure helps,’” added Louise Whalen.

Every shopper CityNews spoke with at the market is concerned about the cost of living, but so too were the vendors.

Nancy Barnes says high costs for fuel, utilities, staffing and rent is leaving her employer and other small-business owners with no choice but to pass it on.

“They have to raise their prices. Because their prices have been raised in order to raise their animals or their vegetables or tend their gardens. It’s sad that it’s come to that,” Barnes said.

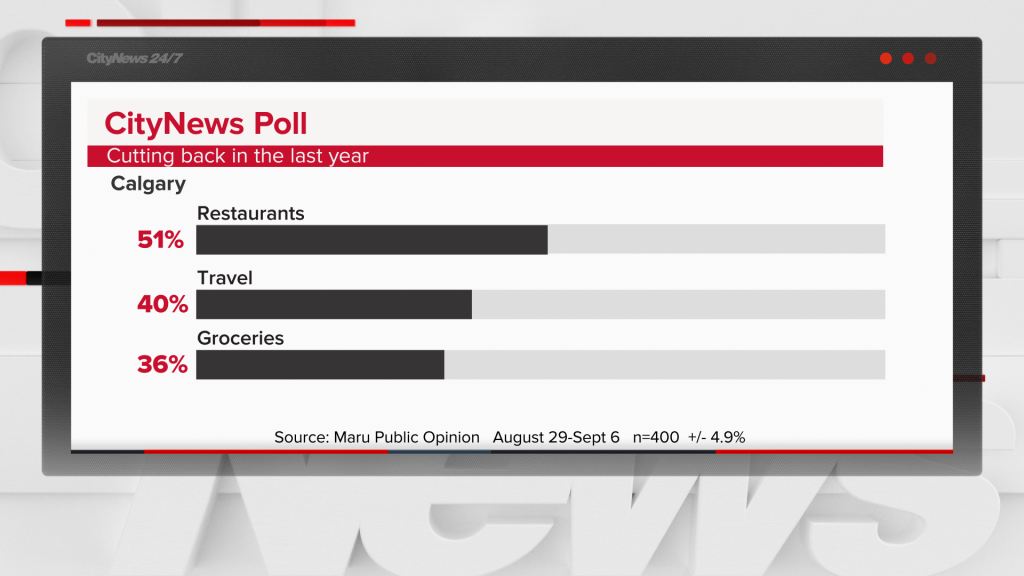

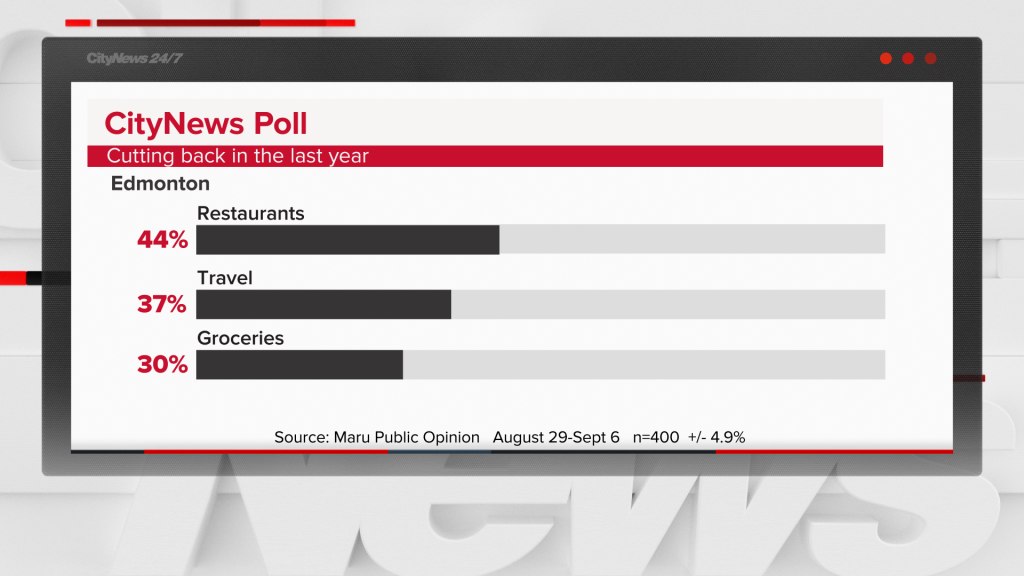

In all every city polled for CityNews, people said they are cutting back on eating out in restaurants and looking for ways to save on groceries. In Calgary, 40 per cent are taking fewer vacations.

“My daughter is going for work, so she’s off,” Joseph Caulder said at the Calgary International Airport.

“Even going out to a movie right now is a luxury. … Travel is also something we don’t do. Holidays are at-home holidays now.”

Most are blaming the Trudeau Liberals

So who’s getting the blame for high prices? In Calgary and Edmonton, an identical 85 per cent pointed their finger at the federal government. But more than 70 per cent also said the province and their city councils have played a role in high costs.

The good news for everyone: Canada’s inflation rate is down to two per cent, falling from a high of eight per cent two years ago.

Mortgage rates are also being cut, a start to much-needed relief for roughly four-in-10 Albertans struggling to pay for housing.

CityNews will be releasing more polling results in the coming days as part of a series called CityBeat, including how mayors Amarjeet Sohi and Jyoti Gondek polled, as well as the biggest issues facing people in both Calgary and Edmonton.