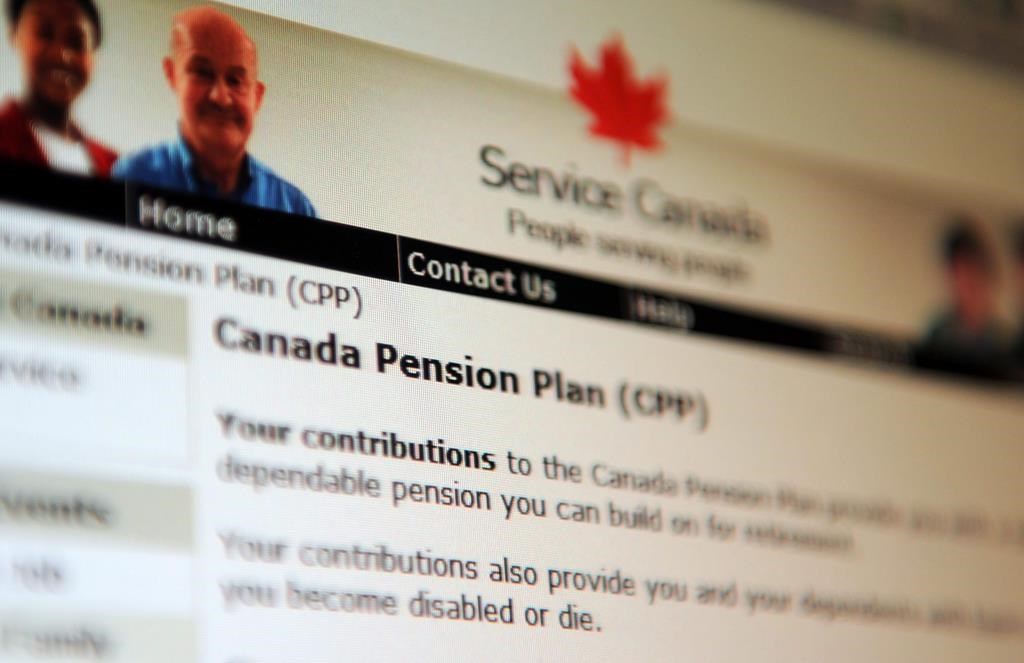

More questions raised at second Alberta town hall on pensions

Posted Oct 25, 2023 11:57 am.

Last Updated Oct 25, 2023 2:21 pm.

Members of the Alberta Pension Panel were in the hot seat Tuesday night during a lengthy town hall meeting with southern Albertans.

Callers from across the region had the chance to question the specifics of Alberta’s plans to leave the Canada Pension Plan (CPP).

Some questioned whether or not leaving the CPP is fair to the rest of the country. Others wanted to know how much influence Alberta politicians would have on future investments, wondering how the government would ensure portfolio management would be free of political interference.

Panellist Mary C. Ritchie noted Alberta already manages about $110 billion in public service pensions already.

“That would be an essential thing for me as part of this — that it would manage in the best interest of the stakeholders — those of us that have contributed to the pension plan,” she said.

Related stories:

- Alberta’s Pension Plan feud escalates amid public feedback panel

- Trudeau chides Smith for pension exit debate, promises to defend stability of CPP

- Canada Pension Plan board says Alberta pension exit consults are biased, manipulative

Meanwhile, another caller pointed out some major risks associated with leaving.

“Given the current market scenario of how it is and if we go ahead with an Alberta Pension Plan, what happens in the downturn?” he asked. “When there’s a downturn in the market with this, all this money … If something happens — what happens to the pension?”

Ritchie responded by saying market downturns also impact the CPP investment board, and it’s something that would need to be handled on a provincial level.

But the biggest concern seemed to be the validity of the Lifeworks report that found Alberta would be entitled to $334 billion — more than half of the CPP’s assets — if it were to leave.

Watch: Explained: Alberta’s proposed Canada Pension Plan exit

“Everyone here, including yourselves, knows there’s no world — none — where Alberta gets half of the Canada pension plan,” one caller said Tuesday night. “It’s based on insanity.”

That caller also noted that Albertans should get confirmation of that number from the CPP, not just the Alberta government, before any future discussions take place.

However, APP panel chair Jim Dinning said the report is completely accurate, as it’s based on carefully crunched numbers from more than 65 years.

“It seems impossible, I’ll grant you that. But, the fact is we have a younger population, with higher than average earnings, with more people actually working and less of us drawing benefits from that pool — using the CPP –and all of you add that up over 56-plus-years,” he said.

Another hot topic was the future of a referendum, and whether or not one would definitely take place, to which Dinning said, “the jury is still out.”

Other provinces step in

On Wednesday, Ontario Minister of Finance Peter Bethlenfalvy posted a letter addressed to federal Minister of Finance and Deputy Prime Minister Chrystia Freeland to ‘X’, asking her to convene an urgent meeting of Canada’s federal, provincial, and territorial ministers to discuss Alberta’s proposal to withdraw from the CPP.

Today, I sent a letter to the Deputy Prime Minister and Federal Minister of Finance, Chrystia Freeland requesting she convene an urgent meeting of Canada’s federal, provincial and territorial finance ministers to discuss Alberta’s proposed withdrawal from the Canada Pension Plan. pic.twitter.com/6FOMFpjS7H

— Peter Bethlenfalvy (@PBethlenfalvy) October 25, 2023

“We believe this proposal could cause serious harm over the long term to working people and retirees in Ontario and across Canada,” he wrote, in part.

Bethlenfalvy goes on to say he has the “greatest respect” for Alberta and is proud to stand alongside the province’s energy sector, but that he has serious concerns about the province’s plans to leave.

“The CPP’s greatest strength is its pan-Canadian approach that provides stability for workers and their families, so Canadians can be sure they have a reliable retirement plan, no matter where they live, work, or choose to retire,” he said.

The Ontario minister also said the fund belongs to all works and beneficiaries across the country, and if one of the partners chooses to leave the CPP “it must be divided fairly, acknowledging the contributions made by workers in each participating province and territory.”

Alberta responds, welcomes ‘good faith, rigorous analysis’

Wednesday afternoon, Alberta Finance Minister Nate Horner responded to Ontario’s Bethlenfalvy, by making public a letter to federal Minister of Finance Chrystia Freeland which opened the door to Alberta hosting the next federal, provincial, and territorial (FPT) finance ministers’ meeting in Calgary.

I sent a letter to Minister Freeland indicating that Alberta would like to host her and my provincial and territorial counterparts in Calgary at the next finance Ministers meeting. Alberta welcomes all good-faith, rigorous analysis of the report produced by LifeWorks. pic.twitter.com/H1vqJQ8EQ7

— Nate Horner (@NateHornerAB) October 25, 2023

“I recommend that Alberta’s potential establishment of an Alberta Pension Plan be on the agenda, and we welcome all good faith, rigorous analysis of the CPP Act withdrawal formula in advance of that meeting,” Horner wrote, in part.

Horner also suggested that topics on the agenda for the next meeting of finance ministers should include Alberta’s white paper on equalization reform, the province’s concerns with the federal Fiscal Stabilization formula “that needs to be resolved,” and the federal government’s carbon tax.

More events to come

Five telephone town halls were scheduled throughout October and November by the province, aimed at engaging with Albertans on the proposal to leave the CPP.

So far, northern and southern Alberta have been given the chance to have their thoughts heard, while events for Calgarians, Edmontonians, and central Albertans are set for the coming weeks.