More than half of Albertans living paycheque to paycheque

Posted Oct 7, 2022 7:19 am.

Last Updated Oct 7, 2022 7:43 am.

Rising costs associated with inflation and interest rates are having a dramatic impact on the day-to-day lives of Albertans.

The results of Canada’s 2022 Affordability Index shows a majority of people in the province are hardly making ends meet.

More than 50 per cent of Albertans say they are living paycheque to paycheque while six in 10 Canadians are either saving less money, or saving none at all.

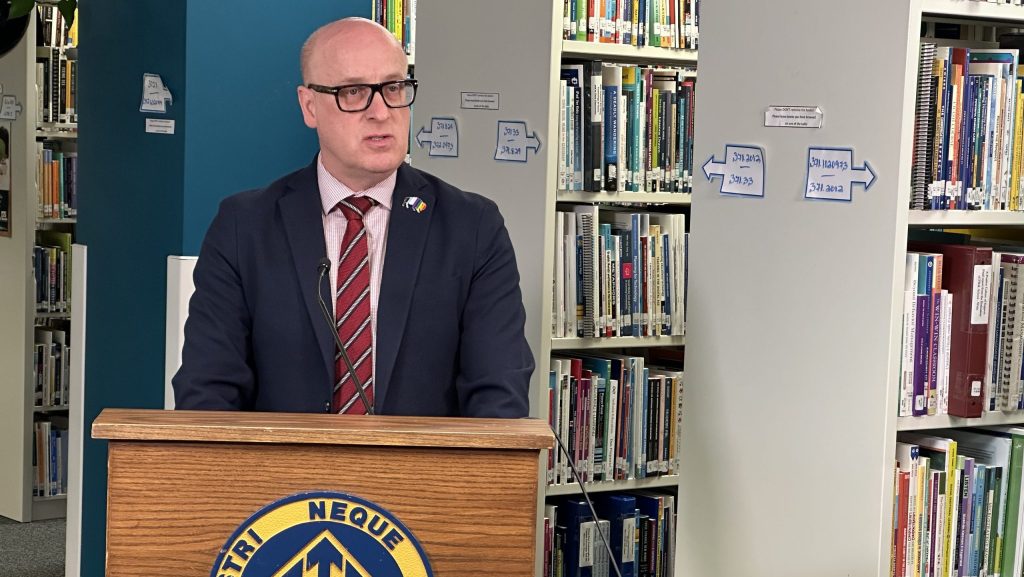

Jordan Day, a licensed insolvency trustee at BDO Canada, says “it is indeed surprising, but given what we’ve been through over the last several years, it’s not completely unforeseen.”

Day says the 2022 BDO Affordability Index shows the rest of Canada is struggling just as much as Albertans are.

“Approximately a third of Canadians are finding it difficult to put food on the table. About half of Canadians are finding it difficult to deal with the rising costs of transportation. And so, the day-to-day impact on Canadians and of course, by extension Albertans, is significant. Clearly, we’re struggling to make ends meet.”

READ MORE:

-

Turkey turmoil: rising food prices blamed for an expensive Thanksgiving

-

Canada’s economy grew by 0.1% in July, outperforming preliminary estimate

-

Calgary small businesses dealing with high inflation

Albertans tell CityNews their biggest financial struggles range from being able to afford gas and groceries, to saving for retirement.

Day says Albertans appear to be in the worst position when it comes to saving for retirement when compared to the rest of the country.

“Approximately 30 per cent of Albertans saying that their financial readiness for retirement is terrible. The idea, the notion of saving becomes more and more distant, less and less likely,” Day said.

The index results also show 70 per cent of Albertans have been saving less money than they did in 2021, while almost 40 per cent of people in Alberta and 30 per cent in Canada feel it’s unlikely they will be able to own a home in the next few years.